Let's say we found our expert advisor and we are scratching our head thinking what lot to use for it. We know that using too much can ruin even the best trading robot, but if we play too safe will not bring good profits. So here are several key things that may help us determine what lot to use.

Do we understand what the expert advisor does?

Ok, it is profitable, but why? What is the reason for that? What is the market element that is being exploited? If we know the answers, then we will know how much we can trust the expert advisor. For example, let's say we have an expert advisor that trades a forex pair with big interest differential. We analyze the expert advisor and find that it trades only on the positive side of the swap, and it is winning because of it. Of course, swaps change too. This means that there is a high chance for our trading robot to work until that swap number is in a specific range. Knowing that we can assume that the expert advisor will keep the performance in the past until the swap is in the current range. Then we can calculate the lot, in a way when the maximum historical DD x 2 will be = to the money we are ready to risk.

The "Bell"

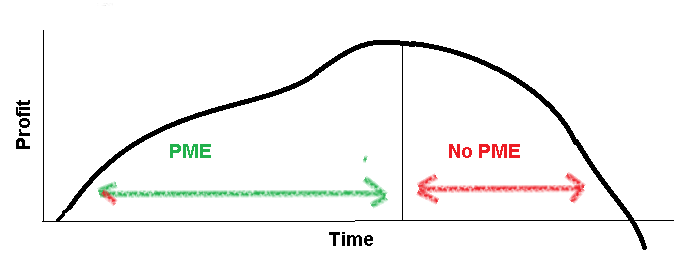

What happens if we can't understand how our expert advisor works. Then we will not have an idea when it will stop working. What we know is that it will stop working and that there is a high chance at a certain point to make the "bell".

It will be ok while we climb, but at the top of the "bell", we will be with our maximum lots. A 30% loss of the earned points with the highest lots will result in losing almost all earned money.

In such cases using a fixed amount of lots in the whole time is our best bet. If the bell starts to form 30% points from the top, this will mean that we lost only 30% of the profit. It will be a temptation to increase the lots while climbing, but we must keep the lot because the bell can start just after we increase the lots.