The risk

Probably all of you have heard many times that holding all the eggs in the same basket is a bad idea and that diversification is good. However the diversification means less risk, and as we all know the profit always depends on the risk. So single expert advisors will always be more profitable than a portfolio of expert advisors because it will be the more risky way. The main reason for that is the DD. We know the historical DD, but we don't know what will happen in the future. We should expect that the biggest DD will come in that future. So if we have 10% historical DD, we must be prepared for 2-3 times bigger drawdown. But what happens if we have 10-20 expert advisors? What will be their combined DD in the future? The truth is that we don't know. This will bring us to much lower lots for the portfolio of systems.

Is this a race?

If our goal is to choose the best expert advisor from a list and choose the most optimal money management for it and achieve the maximum profit from it then probably we are participating in an expert advisor demo contest. In the real world, there is not a single parameter that can tell us for sure what will be the performance of a trading robot. We must depend on luck to choose an expert advisor and money management. Do we need this?

What we really need

What we need are a good strategy and stable profits. And we can be sure that it will pay off in the long run. We may not choose the best expert advisor, but with the right methodology, we can choose 10 expert advisors from which 8 will perform well in the future. That methodology will also help us in the future when we have substitute several of the bad performing forex robots.

What will happen if we choose only one expert advisor and it starts going down? Is this normal? Is this a DD? How long to wait before choosing another? These are hard questions, and in such a situation, under pressure, we can take the wrong decisions.

The graphs

Let's take several Expert Advisors and combine them in a portfolio.

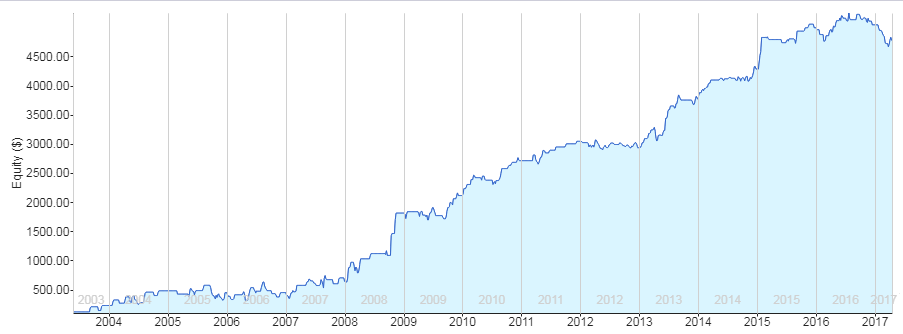

Expert advisor 1

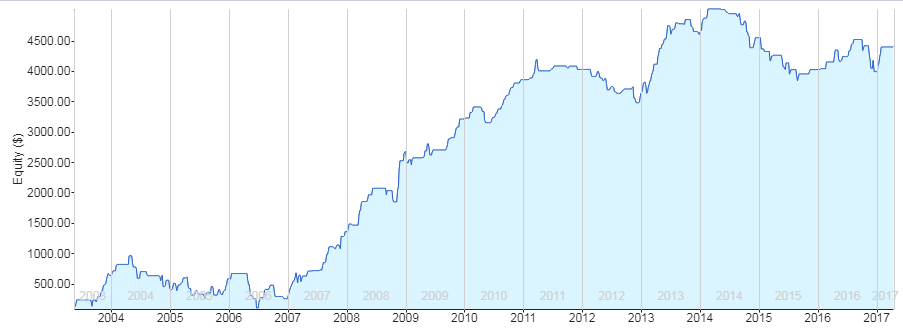

Expert advisor 2

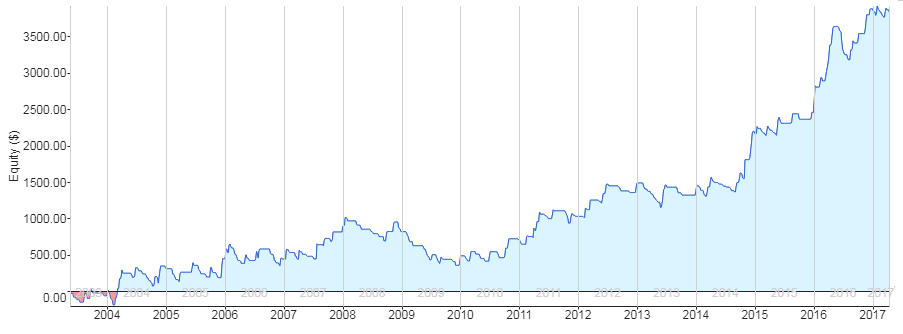

Expert advisor 3

Expert advisor 4

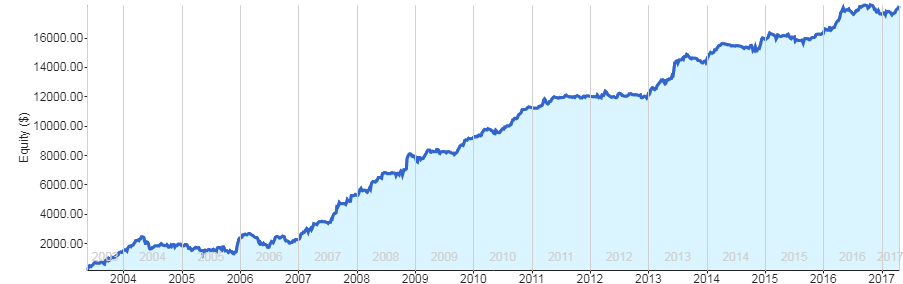

Here is how the portfolio of that 4 expert advisors will look like :

It is visible that many of the expert advisors don't perform well in different periods, but when they are in a portfolio , the result is much smoother equity line.

Final words

If our goal is to make stable profits and keep moving forward there is no dought that conservative portfolio is the way to go. It will not only make the profit more stable, it will also remove the stress and also remove the situations when we will have to make decisions under pressure.