Forex EA - Expert Advisors (Forex Robots) for automated trading

Are you looking for a Metatrader 4 or 5 forex robot for trading on the foreign exchange market? You are in the right place - check out our selection of forex ea with an expectancy of up to 20 points per trade. All deals from our forex robots are executed with a fixed lot.

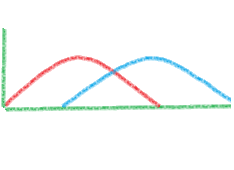

The top 6 forex ea portfolio executed 1713 trades total with summary output of 2621.1 points. Below is the chart of the portfolio from the top 6 forex robots.

Cable Trader (GBPUSD)

iChi (EURUSD)

MPower (EURUSD)

DayTrader (EURUSD)

FxRobotA (USDJPY)

The systems have no money management or other elements of risk accumulation. Data on charts are updated every hour and shows how many points the systems win. There will be a constant process of adding new forex expert advisors with good expectations and removing these with bad results.

Choose the right forex ea for your algo trading

Trading with forex ea is a marathon, not a sprint. Going fast with huge risk equals throwing your money from the window. Avoid trading systems with risk accumulation. Don't be fooled by nice smooth equity curves, because they hide huge risk. The real trading systems don't have such a nice equity curve. They have their drawdowns and stagnations. Use small lots, don't take unnecessary risks. Slowly build your trust in the expert advisors, see what correlation they have. See how they do when the market is in range and trend. Make a big portfolio of expert advisors, but only from good profitable forex robots. You don't want the profit from the good systems to be lost from the bad.

Why do i need a forex trading robot?

Probably if you are new to the forex market you will ask this question. Maybe you think that the human brain can process the chart information better and make better forex analysis and decisions about the possible market directions. Well... you are wrong. The forex market is unpredictable as the most things in our lives. If the market becomes predictable, it will stop existing. Then what can we do? We can monitor and find specific market situations after which something is happening. Of course, you will never find such case in where after A follows B in 100% probability. But you can find a 60% one. And this will lead to developing a forex trading strategy and when the strategy is crystal clear, it can be coded into expert advisor. If we need to make an expert advisor definition, it will be - trading robot based on statistics.

How to choose the best forex trading system

No matter how many stats you watch, no matter how good the equity curve looks, you never know how it will perform in the future. It is possible that an forex robot that has medium results, to be much better than the best forex ea now. Let's say that a good-looking expert advisor has a 60% chance to be also good in the future. So if we choose 1, from which it will be - from the 40 losing or the 60 winning? Again... we don't know. But the bigger portfolio of experts we make, the closer we get to that 60 -40%. What if we monitor closely the things and shut down the bad performers and substitute them with better expert advisors? Then we can reach 70-30 or even higher.

Why the forex ea can stop working?

As everything around us, the markets change too. The swaps change. Economic results change. Market volumes change. Trends are becoming bigger or smaller, ranges are becoming wider or thinner. The forex expert advisor is designed to work within some specific market parameters. When they change beyond a certain limit, the ea will stop working as expected. Usually, this doesn't happen right away but like a process when the forex ea is constantly getting less and fewer profits. We must be prepared that all the expert advisors will fail at a certain point and the questions are not if, but when.

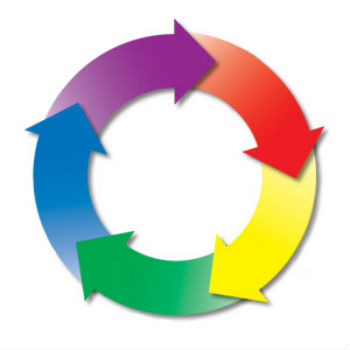

The lifecycle of the forex automated trading systems

There are many types of forex ea and many lifecycle models but the one we choose is test, out of sample test and trade. The test is the largest period where we test our rules. It must be big enough to get enough trades for good stats and not so big, because as we said in the previous paragraph -it can be close to its end or have bad backtest results just because we are including different market conditions. For example, 10-15 years ago we had 5-8 points spread on EURUSD, now we have 0.8. If we test on such old data we will have good results which are not real. We have chosen that backtest period to be close to 2 years. The next important period for the forex robot is the out of sample test. In this test, we verify that the system still have the same performance parameters as in the test period. If the system can pass that period it is ready for trading. In the most common case, we have 2 years backtest, 6 months out of sample test and 1-year trading.

Is it possible one trading robot to have different results?

Yes. The trading robots logic is restricting them to have more than one position at a time. This means that they may have many entry signals, but they can use them only when there are no other open positions. This means that if you download an expert advisor and start it at a different time/price, your positions can be different from the same system which is started at a different time. Usually, after several local trends, the forex ea will start making the same positions, but there is a chance that this will not happen for some specific expert advisors.

Grid expert advisors

The trading systems represented in this section have risk accumulation. Grid trading is not necessarily bad, but if you plan to use such systems you need to understand how they work and where is their weakness. FXZIG expanding grid FXZIG two by two grid FXZIG fixed grid