The market is changing every minute. It is changing the volatility, it is changing the liquidity, and it is changing the participants. In a certain moment of these constant changes, we can find rules, that can give us Positive Mathematical Expectancy and we can build expert advisors that use that for profitable trades. But to do that we need some history so we can find those rules and backtest them.

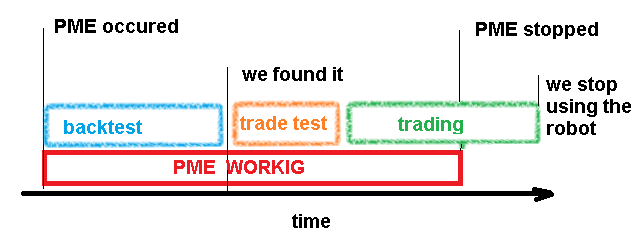

In the figure above it is visible that we need the "backtest" time to identify the PME. The longer this period is, the shorter time we will have to trade it. On the other hand, if we don't have enough time for backtesting we may not have enough statistical data for proper evaluation. The trade test is needed to see if there is something that happens differently in real market conditions, that can't be detected in the backtests. It can be shortened but skipping it is a really bad idea. The worst thing in the figure above that we will continue trading after the PME will stop because we will think that this is just a bigger drawdown.

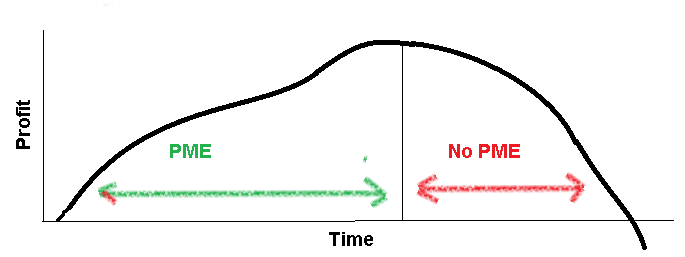

If we look at the profit curve of the usual expert advisor it will look similar to this "bell" shape :

Unfortunately in real trading, it is very hard to see that shape while it is forming because of the fluctuations. In every big DD, we can see the end of the Expert Advisor and we can stop it too soon.

As a conclusion, we can say that finding the right methodology when to stop an expert advisor is as important as finding the rules of the expert advisor because the money that we will earn from an expert advisor will be equal to the money we will earn minus the money that we will lose before we stop it.